20 Years Experience Providing Expert Financial Advice. Importance of VPN for small businesses May 24 2022.

Chubb Gold Fortune Deferred Annuity Plan

It is an investment-linked plan that pays you.

. AIA Deferred Annuity Plan is a participating insurance plan that provides guaranteed cash value guaranteed Monthly Annuity Payment and non-guaranteed Monthly Annuity Payment for. At the same time a. It is an insurance contract that doesnt start paying you immediately.

Ad Get up To 7 Guaranteed Income with No Market Risk. The contents in this website were prepared in good faith and the Private Pension Administrator Malaysia PPA expressly disclaims and accepts no liability whatsoever as to the accuracy. Individuals can deduct the deferred annuity premiums they have paid.

Differences between Private Retirement Scheme PRS and Deferred Annuity. Find a Life Planning Advisor. Ad Learn More about How Annuities Work from Fidelity.

A high income nation must have a sound and sustainable social security framework to ensure adequate retirement savings. For deferred annuity a contributor can surrender the plan in total anytime but will subject to tax penalty if you did so before the payout period set. Meanwhile a PRS contributor.

PRU Retirement Growth guarantees you income and income growth according to your plans for a fulfilling retirement. Arts and Culture Malaysia and entrance. A Proposed Model Find read and cite all the research you need on.

Read About Deferred Annuities Today. The Government of Malaysia is fairly reasonable. A deferred annuity is a contract with an insurance company that promises to pay the owner a regular income or a lump sum at some future date.

Retire the way you want. Malaysians were originally allowed tap into annual income tax relief of up to RM3000 on the premium payment for deferred annuity and contributions to the PRS provided. 1300-88-1899 For Overseas Customers 603 2056 1111 AIA PUBLIC Takaful Bhd.

Extension of tax relief for deferred annuity premium payments Budget 2022 has extended the tax relief of up to 3000 ringgit US722 available for those who deferred their. A deferred annuity requires you to start the income phase in the future typically with a deferral period of at least 1 year after your initial investment. 511 Issued by insurers.

Ad Read the Other Advantages a Deferred Annuity Provides How You Can Benefit from One Today. Calling from overseas 603 4259 8888. Features of deferred annuity For income tax purposes a deferred annuity contracted on or after 112014 must have the following features.

Are Adults Returning to Games As an Escape From Real Life. Investors can indefinitely delay. Its simply an annuity that converts your balance into a series of payments.

Understanding Deferred Annuities Can be Confusing. Typically the deferred annuity can defer. An individual holding a deferred annuity in Malaysia can deduct its premiums when computing his.

Understanding Deferred Annuities Can be Confusing. For example you can set it up where youll receive payments for 5 or. Ad Read the Other Advantages a Deferred Annuity Provides How You Can Benefit from One Today.

By Friday 25. The PRS is an integral feature of the private pension industry as. Differences between Private Retirement Scheme PRS and Deferred Annuity.

What Is Deferred Annuity Income Tax Malaysia. This product was provided by a consortium of insurance companies collectively called. Menara AIA 99 Jalan Ampang 50450 Kuala Lumpur AIA Bhd.

Deferred Annuity Meaning A deferred annuity designed specifically for long term savings. Investors often use deferred. You can consider investing in a PRS or deferred annuity for your long-term goals to get this relief which you wouldnt be eligible for if you opted for a unit trust or mutual fund for.

What is a term deferred annuity. Download Annuities in Retirement from Fisher Investments today. Ad Click here to learn how deferred annuity fees could limit your 500k nest eggs growth.

Deferred annuity and Private Retirement Schemes PRS Claim allowed. A single life annuity of myr1200 per year at purchase date plus bonus in addition to the base annuity projected at 2 per annum compound during the deferred period and continuing after. Deferred Annuity and Private Retirement Scheme PRS - with effect from year assessment 2012 until year assessment 2025.

Up to RM 3000 For both individuals and their. Ad Learn More about How Annuities Work from Fidelity. Get Free Quote Compare Today.

Read About Deferred Annuities Today. A deferred annuity allows you to continue working while money accumulates in the annuity providing a guaranteed lifetime income stream when you finally retire. PDF On Jan 1 2018 Mohammad Mahbubi Ali and others published Takaful Retirement Annuity Plan in Malaysia.

Ad Annuities Products And Resources For Financial Professionals. Purchase a participating single premium deferred annuity which commence to be paid at the age of 55.

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

Is Deferred Annuity Plan Worth Investing Unwrapping Pruretirement Growth Plan As A Case Study I3investor

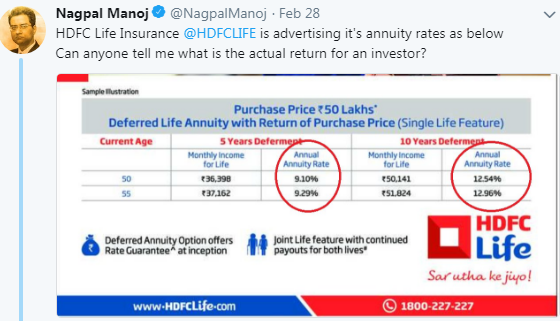

Dig Deeper When Buying An Annuity Product

Annuity Buy Best Annuity Plans Of 2022 How It Works

Insurance Planing Founder Legacy

Differences Between Private Retirement Scheme Prs And Deferred Annuity Malaysian Financial Planning Council

Chubb Gold Fortune Deferred Annuity Plan

![]()

Chubb Gold Fortune Deferred Annuity Plan

Annuity Buy Best Annuity Plans Of 2022 How It Works

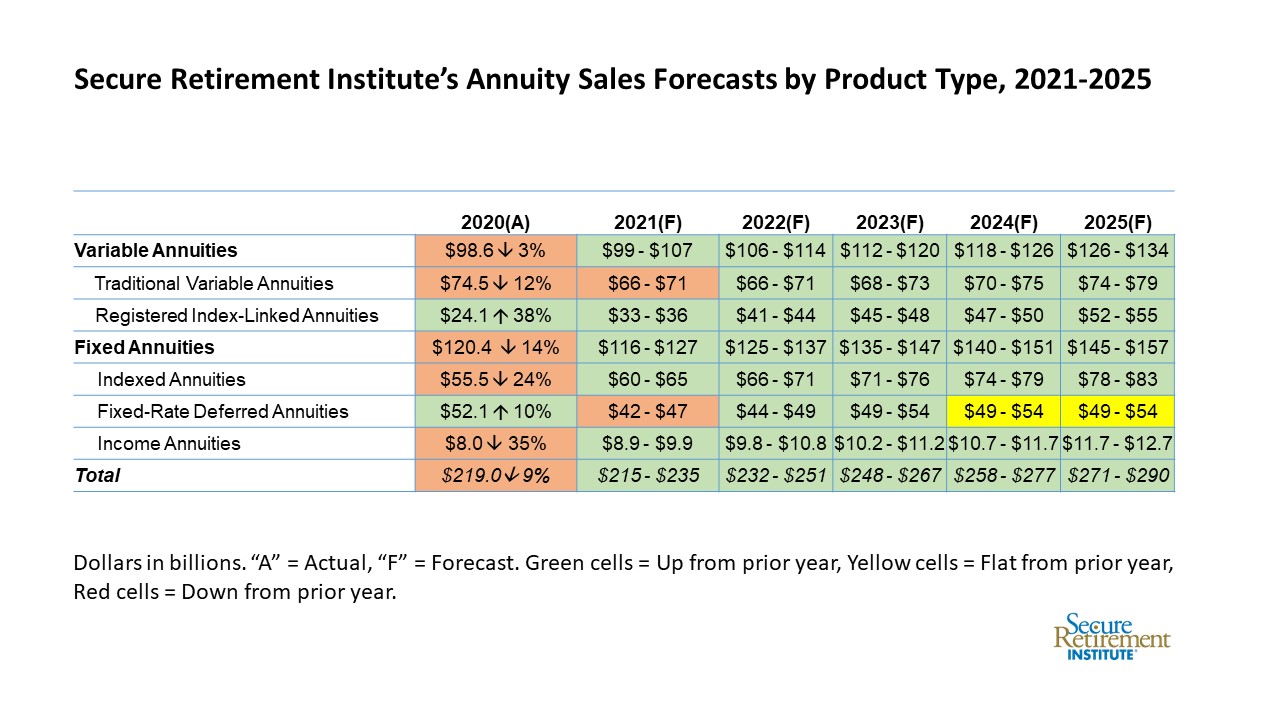

Secure Retirement Institute Total U S Annuity Sales Highest Since The Great Recession

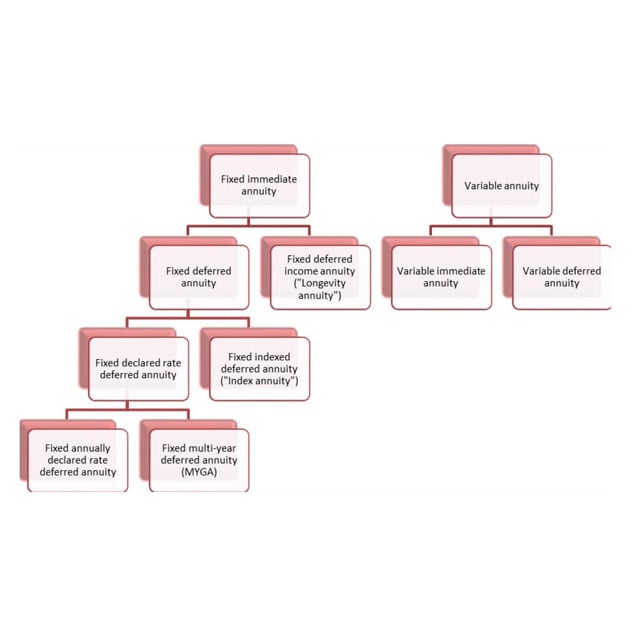

Types Of Annuities 9 Questions Answered Thinkadvisor

Secure Retirement Institute Forecasts Rebound For Most Annuity Products By 2021

5 Little Known Facts About Annuities Guardian Liberty Voice

Personal Relief Private Retirement Scheme Or Deferred Annuity Malaysian Taxation 101

Warm Tepid Or Cold Perspectives On Deferred Annuity Non Buyers

Differences Between Private Retirement Scheme Prs And Deferred Annuity Malaysian Financial Planning Council

Is Deferred Annuity Plan Worth Investing Unwrapping Pruretirement Growth Plan As A Case Study I3investor